Nifty 50 ends above 26,000, Sensex settles over 85,000 in ongoing rally | Stock Market Today

The domestic equity benchmarks concluded a volatile trading session on a positive note on Wednesday, with the benchmark Nifty index closing above the 26,000 level. Despite a weak start, the indices managed to gain momentum throughout the day, reaching a new all-time high. Key sectors that drove the market’s uptick included media, realty, and metals. However, PSU banks and consumer durables stocks faced downward pressure. The positive sentiment was bolstered by the Nifty’s sustained position above 25,900, indicating strong support from aggressive put writing. Technically, the Nifty’s momentum indicator remains positive, suggesting a continuation of the upward trend.

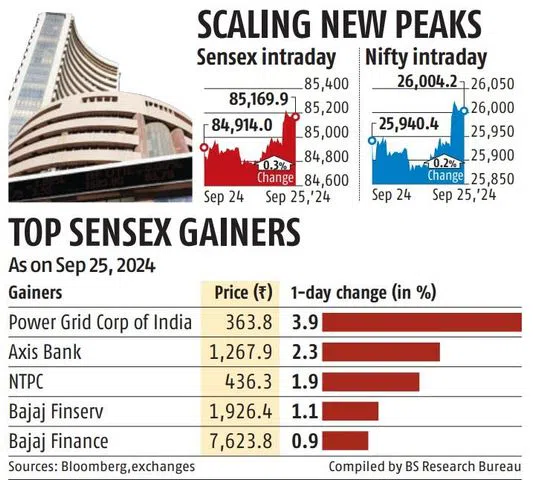

The S&P BSE Sensex rose 255.83 points or 0.30% to 85,169.87. The Nifty 50 index added 63.75 points or 0.25% to 26,004.15. Both the indices attained record closing high levels.

Power Grid Corporation of India (up 3.91%), Axis Bank (up 2.18%) and HDFC Bank (up 0.59%) boosted the indices today.

The Sensex and Nifty clocked a record high of 85,247.42 and 26,032.80, respectively, in late trade.

In the broader market, the S&P BSE Mid-Cap index fell 0.53% and the S&P BSE Small-Cap index shed 0.35%.

The market breadth was negative. On the BSE, 1,697 shares rose and 2,256 shares fell. A total of 112 shares were unchanged.

)

Economy:

Moodys has revised its calendar year 2024 growth forecast for India to 7.1% from its earlier estimates of 6.8% in June, as it expects growth in the Asia-Pacific region to outpace the global economy.

Numbers to Track:

The yield on India’s 10-year benchmark federal paper advanced 1.42% to 6.857 as compared with previous close 6.876.

In the foreign exchange market, the rupee edged higher against the dollar. The partially convertible rupee was hovering at 83.5975, compared with its close of 83.6300 during the previous trading session.

MCX Gold futures for 4 October 2024 settlement rose 0.17% to Rs 76,341.

The US Dollar index (DXY), which tracks the greenback’s value against a basket of currencies, was up 0.02% to 100.48.

The United States 10-year bond yield grew 0.49% to 3.756.

In the commodities market, Brent crude for November 2024 settlement lost 49 cents or 0.65% to $74.68 a barrel.

Global Markets:

Most shares in Europe and Asia declined on Wednesday as investors digested Chinese stimulus measures. Swedens Riksbank on Wednesday cut interest rates by 25 basis points to 3.25% and suggested the policy rate could be reduced further at the two remaining monetary policy meetings this year.

The People’s Bank of China (PBOC) reduced the medium-term lending facility (MLF) rate to 2%, down from 2.3%. This marks the second MLF cut in approximately three months, following a decrease from 2.5% to 2.3% in late July.

Additionally, investors assessed Australia’s inflation figures released on Wednesday. The consumer price index (CPI) increased by 2.7% year-on-year in August, reflecting a decrease from the 3.5% rise recorded in July.

In the United States, the S&P 500 (+0.25%) reached a new all-time high Tuesday, shrugging off concerns about weak consumer confidence. Nvidia’s shares surged 4% following news that CEO Jensen Huang had completed his stock sales.

The Dow Jones Industrial Average (+0.20%) and Nasdaq Composite (+0.56%) also recorded gains.

US consumer confidence suffered its biggest one-month decline in more than three years, hitting 98.7 for September. The data follows a warning from JPMorgan Chase CEO Jamie Dimon about increasing geopolitical instability cast a shadow over the positive market sentiment. Dimon expressed concerns that these geopolitical tensions could impact the global economy.

Stocks in Spotlight:

The Nifty Media index jumped 2.94% to 2,139.25. Saregama India (up 14.93%), Zee Entertainment Enterprises (up 5.77%) and Tips Industries (up 3.25%) surged.

Gillette India slipped 3.05% after the companys distributor notified that Procter & Gamble (P&G) Bangladesh terminated the distribution agreement with effect from 31 December 2024.

Delta Corp advanced 3.44% after the companys board approved demerger of its hospitality and real estate business into a newly incorporated company named as Delta Penland (DPPL).

Mahindra Holidays & Resorts India shed 0.97%. The company, via its flagship brand Club Mahindra, has assumed the complete management of the Club Mahindra Golden Landmark resort in Mysuru, Karnataka.

Mazagon Dock Shipbuilders (MDL) added 0.67%. The company announced the commencement of production activity for the first multipurpose cargo vessel (MPV) for Denmark’s Navi Merchants.

Man Infraconstruction rose 1.95% after the company announced that its Mumbai-based project, having a revenue potential of about Rs 1,650 crore, has achieved nearly full sales.

Snowman Logistics dropped 4.04% after the company said that its Chief Executive Officer (CEO), Sunil Prabhakaran Nair has resigned with effect from the close of business hours of 30 November 2024, due to his personal reasons.

Ecos (India) Mobility & Hospitality slipped 2.22% after the company reported standalone net profit of Rs 13.50 crore in Q1 FY25, marking a de-growth of 2.87% as compared with the PAT of Rs 13.90 crore recorded in Q1 FY24.Revenue from operations increased by 14.01% to Rs 148.90 crore in Q1 FY25 from Rs 130.60 crore posted in Q1 FY24.

IPO Update:

The initial public offer (IPO) of KRN Heat Exchanger and Refrigeration received bids for 26,08,36,485 shares as against 1,09,93,000 shares on offer, according to stock exchange data at 17:00 IST on Wednesday (25 September 2024). The issue was subscribed 23.73 times.

The issue opened for bidding on Wednesday (25 September 2024) and it will close on Friday (27 September 2024). The price band of the IPO is fixed between Rs 209 to Rs 220 per share. An investor can bid for a minimum of 65 equity shares and in multiples thereof.

Manba Finance‘s IPO received bids for 1,89,91,90,750 shares as against 87,99,000 shares on offer, according to stock exchange data at 17:00 IST on Wednesday (25 September 2024). The issue was subscribed 215.84 times.

The issue opened for bidding on Monday (23 September 2024) and it will close on Wednesday (25 September 2024). The price band of the IPO is fixed between Rs 114 to Rs 120 per share. An investor can bid for a minimum of 125 equity shares and in multiples thereof.

Powered by Capital Market – Live News

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)