Equity rally fuels fastest quarterly growth in MF assets in five years | Mutual Fund – Top Stories

)

Illustration: Binay Sinha

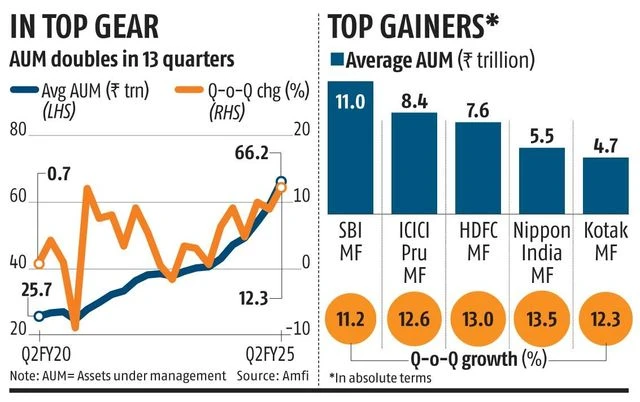

Mutual funds (MFs) managed a record Rs 66.2 trillion in assets during the July-September quarter, marking a 12.3 per cent increase over the previous three-month period — the highest quarterly jump in MF assets in at least five years.

During the April-June period, the average assets under management (AUM) stood at Rs 59 trillion. The sharp rise in AUM, according to experts, is driven by a robust equity market rally and record inflows into equity schemes.

Click here to connect with us on WhatsApp

The key benchmark indices, Nifty 50 and Sensex, each logged approximately 7 per cent gains in the quarter ended September 2024 (Q2FY25). Amid this rally, investors funnelled more than Rs 75,000 crore into active equity schemes over July and August, bolstered by new fund launches.

“Mark-to-market gains in MFs’ equity holdings have been the key factor,” said D P Singh, deputy MD & joint CEO of SBI Mutual Fund. “Growing inflows via the systematic investment plan (SIP) route have also contributed significantly to AUM growth. For a change, inflows into debt funds were also better in last quarter as rate cut hopes boosted investor interest.”

)

SIP inflows have continued to reach new heights, with August figures standing at Rs 23,547 crore, up from Rs 23,332 crore in July. SIP contributions predominantly target equity schemes.

According to Association of Mutual Funds in India (Amfi) data, debt funds recorded net inflows of Rs 1.6 trillion over the July-August period.

Larger fund houses were the biggest drivers of the AUM expansion, thanks to the base effect. SBI MF, the largest fund house, managed Rs 11 trillion in Q2FY25 — an increase of Rs 1.1 trillion over Q1’s average AUM. ICICI Prudential MF’s average AUM rose by Rs 90,000 crore to Rs 8.4 trillion during the quarter under review, while HDFC MF, the third-largest fund house, saw assets climb to Rs 5.5 trillion by a similar quantum.

Among the top five, Nippon India MF recorded the fastest growth rate, with its average AUM expanding by 13.5 per cent.

The strong consistent inflows have positioned MFs as a key market pillar. Over the past few years, MF investments in equities have surged sharply. The first half of FY25 already matches total equity deployment during FY24 — at Rs 2 trillion. In the calendar year 2024, net equity buying by MFs has reached a record Rs 2.8 trillion.

MFs have maintained a streak as net buyers for 17 consecutive months and deployed over Rs 10,000 crore each month for the past 14 months.

First Published: Oct 07 2024 | 7:04 PM IST