822 IPOs globally aimed to raise $65bn till August; India tops APAC tally | News on Markets

)

Illustration: Ajay Mohanty

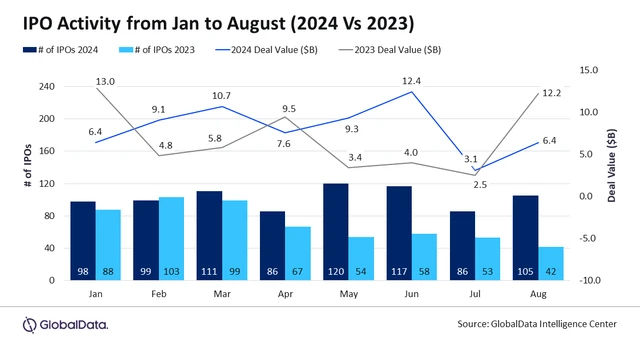

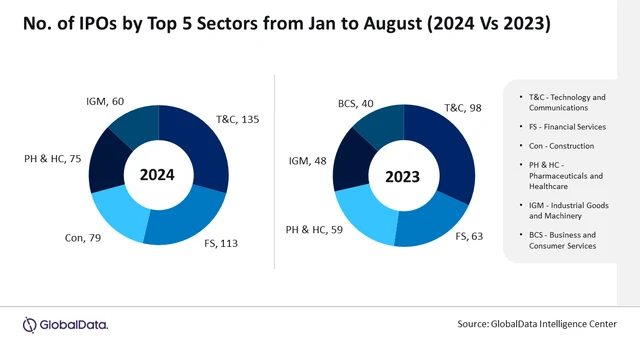

Primary market, it seems, is not only luring investors back home but also globally. A recent report by GlobalData, a London-based data analytics firm suggests that 822 Initial Public Offers (IPO) aimed to raise $65 billion in the first eight months of calendar year 2024 (CY24) till August. This is a 17.4 per cent jump from 2023 when 1,564 listings during the same period planned to mop up $55.4 billion via this route.

Investors, the report suggests, are shifting towards larger, more valuable IPOs at the global level despite the reduced number of listings thus far in 2024.

Click here to connect with us on WhatsApp

“There has been a noticeable shift in investor focus over the past two years, with greater emphasis on the financial sustainability and profitability of newly listed companies. This change signals a more discerning approach from investors, given the backdrop of tighter monetary conditions and persistent market uncertainties,” the report said.

)

India IPO market tops APAC tally

The Asia-Pacific (APAC) region recorded the largest number of transactions, totaling 575, amounting to $23.7 billion in value, while North America had 149 deals valued at $25.4 billion, GlobalData said.

India toped the APAC region with 227 transactions totaling $12.2 billion in the first eight months of 2024, the report said, primarily due to a higher number of small & medium enterprises’ (SME) IPOs. The US came in second with 133 deals of $23.1 billion, while China ranked third with 69 transactions worth $5.3 billion, the report suggests.

)

At the global level, companies planning for IPOs, Gandhi said, are now increasingly prioritising revenue growth, profitability metrics, and sustainable business strategies, reflecting a broader trend towards long-term financial resilience and responsible growth.

Going ahead, the IPO market, he believes, will continue to be influenced by a complex set of factors, including shifts in monetary policy, geopolitical developments, and evolving investor preferences.

“Amidst these, companies that demonstrate strong financial fundamentals and clear growth can appeal to an increasingly selective investor base. The ability to showcase resilience and long-term sustainability will be key for businesses seeking to attract capital in this evolving market environment,” he added.

In the Indian context, a clutch of companies that includes auto major Hyundai Motor India, Swiggy, Hexaware Technologies, NTPC Green Energy, Afcons Infrastructure, Tata Play, and Vishal Mega Mart aim to raise nearly Rs 60,000 crore via IPOs over the next few months.

First Published: Sep 27 2024 | 12:09 PM IST